Financial Foundations - Budgeting

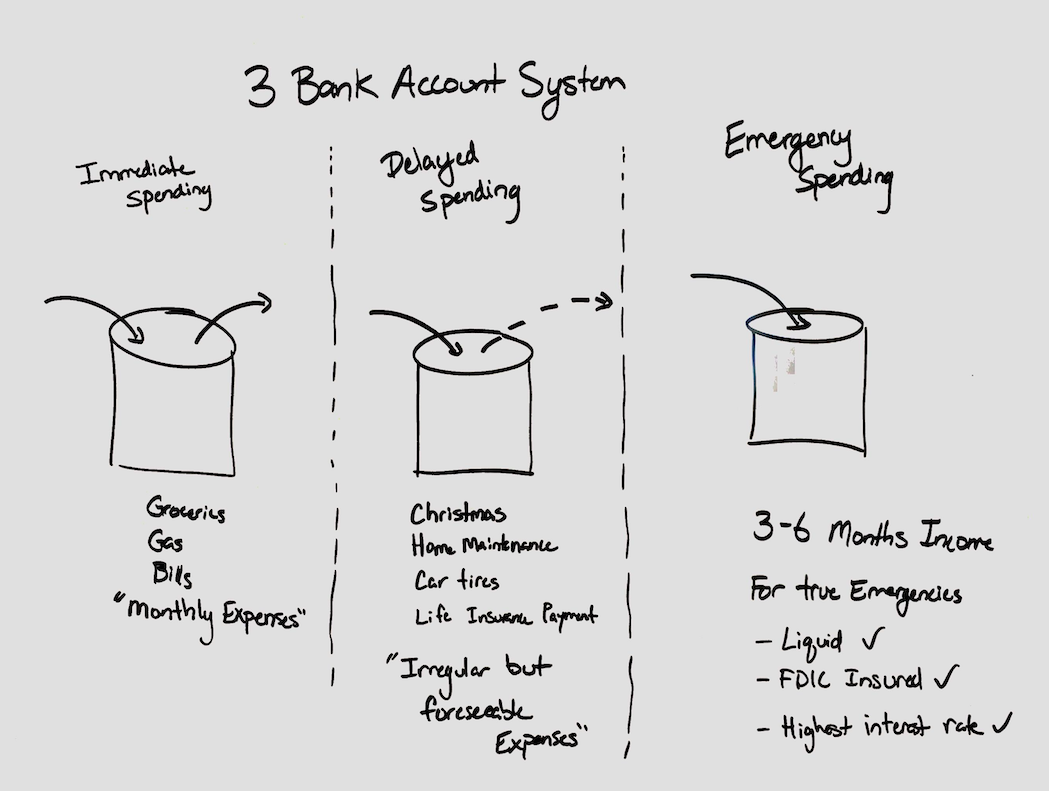

Submitted by Korhorn Financial Group, Inc. on June 19th, 2020Budgeting is the second session in our Financial Foundations series. It is taught by Amy Masters and covers how to create a budget and use KFG's 3 Bank Account System!

By Ben deBock, CFP®

By Ben deBock, CFP® If you’re anything like most Americans, owning a home is one of your top financial priorities. In a recent survey by Chase, 87% of respondents said that buying a house is something they have always wanted. It’s a worthy goal. Not only can owning a house help to build your personal wealth, but a house is also likely to become your ‘home sweet home’ for many years to come. This makes deciding when to buy—and what to buy—among the most important financial decisions you’ll make in your lifetime.

If you’re anything like most Americans, owning a home is one of your top financial priorities. In a recent survey by Chase, 87% of respondents said that buying a house is something they have always wanted. It’s a worthy goal. Not only can owning a house help to build your personal wealth, but a house is also likely to become your ‘home sweet home’ for many years to come. This makes deciding when to buy—and what to buy—among the most important financial decisions you’ll make in your lifetime. We’re headed for a record-setting Valentine’s Day. And though I hate to put a damper on this heart-filled holiday, the revelation that the majority of people are planning to spend more than ever on Valentine’s Day this year is less-than-great news for most gift givers this year.

We’re headed for a record-setting Valentine’s Day. And though I hate to put a damper on this heart-filled holiday, the revelation that the majority of people are planning to spend more than ever on Valentine’s Day this year is less-than-great news for most gift givers this year. Retirement. It seems to be every working person’s dream. But retirement dreams can also cause a lot of anxiety, especially the closer those “golden years” become. With 10,000 Baby Boomers turning 65 every day, the question I hear over and over again is, “Can I retire?” and “If so, when?” The answer isn’t always so easy.

Retirement. It seems to be every working person’s dream. But retirement dreams can also cause a lot of anxiety, especially the closer those “golden years” become. With 10,000 Baby Boomers turning 65 every day, the question I hear over and over again is, “Can I retire?” and “If so, when?” The answer isn’t always so easy.