Save Money and Live Better

Submitted by Korhorn Financial Group, Inc. on October 29th, 2019 By Ben deBock, CFP®

By Ben deBock, CFP®

When I sat down with Mindy and Jim two years ago, they were in pretty good shape financially. With two children and a third on the way, they were diligent savers and had built a solid cushion to cover unexpected expenses. The challenge? They had no idea if they were actually saving enough, and they had no real vision of what they were saving for.

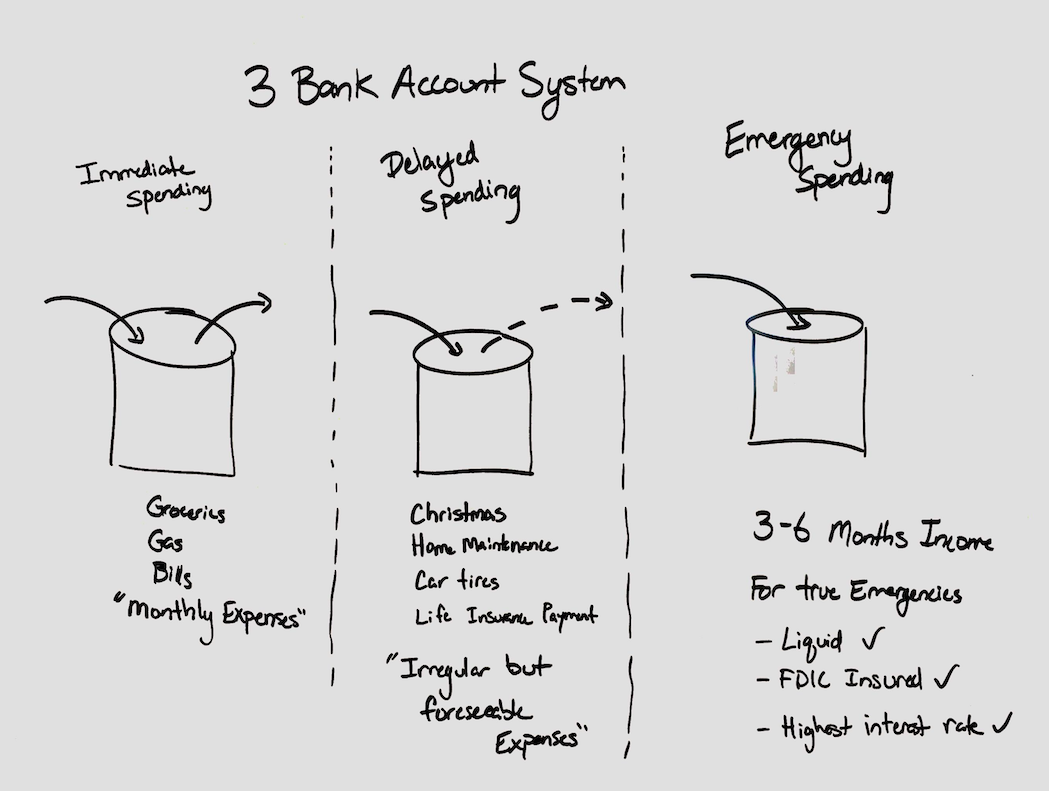

Luckily, I knew of an ideal solution that I was certain could give them the clarity and confidence they were seeking. I was happy to introduce them to the ‘3 Bank Account System’ (with the help of the sketch above on my white board!).

Great for everyone from recent college grads to retirees, the 3 Bank Account System is one of the best and versatile methods I know of for managing day-to-day finances and building long-term success. In fact, I find the system so valuable that my wife and I use it faithfully—every week, every month, and every year! Here’s how it works in a nutshell:

It starts with setting up three separate bank accounts, with each account allocated as a ‘bucket’ for a specific set of financial needs.

- Account #1: Immediate Spending

The Immediate Spending Account (usually a checking account) holds the cash you need to cover your regular, predictable expenses. Groceries, gas, household bills, and mortgage or rent payments usually top the list. To figure out how much you need to contribute to this account, track your spending for two to three months to identify your repeatable expenses, and then estimate how much you’re spending on each one. Add them up, and that total is the amount you will allocate to Account #1 every month.

- Account #2: Delayed Spending

The Delayed Spending Account is to cover your “irregular but foreseeable expenses.” These are things that are predictable, but don’t occur monthly. And because they’re typically not included in the monthly budget, they can wreak havoc on your finances. The reason? All too often, these are the expenses that are paid using high-interest credit cards or other interest-bearing loans. Prime examples are major household appliances, home maintenance (such as a new roof), annual life insurance premiums (which create a multi-hundred-dollar hit), cars, and holiday gifts.

The good news is that every one of these expenses is predictable—at least to some degree. While you may not know exactly when the furnace will go out (though it always seems to happen during the worst cold snap!), it’s a fact that the average lifespan for a furnace is 13-20 years. That means you should ideally be stashing away about $650 each year to cover the $10,000 cost when the time does come. The same is true for every other foreseeable expense. Your car’s tires should be replaced about every 8 years, so adding about $15 dollars a month to your Delayed Spending Account for this predictable expense should easily cover the cost. And if you typically spend $1,000 each year on holiday gifts and entertaining (the national average), putting away $85 every month can help take the financial stress out of the holidays.

The real power of a Delayed Spending Account is that it can dramatically increase your financial strength. By eliminating the need to rely on credit cards or short-term loans, you can start earning interest on your money instead of paying interest to a lender. By getting your longer-term spending into rhythm with your overall finances, you can free up money to fund your bigger financial goals—which are likely much more exciting than a new furnace! In fact, a Delayed Spending Account delivers such a huge return that it may well be one of the best investments you can make in your financial future.

- Account #3: Emergency Spending

The Emergency Spending Account is earmarked for one thing, and one thing only: true emergencies. The loss of a job. Flood or fire. A major health issue. This account is so vital to your financial health that building it should be the #1 priority after your monthly bills are paid. Ideally, this account should include 3 to 6 months of living expenses and be held in an FDIC-Insured, interest-earning account that is free (never pay an annual fee!) and ‘liquid’—meaning that you can access your money within a few days at most.

When choosing where to set up your accounts, seek out a bank that offers the highest possible interest rate and that offers features that work for you. Personally, I use my bank’s online banking because it allows me to create an unlimited number of accounts (I confess that I’ve taken the system to an extreme and use 7 separate accounts to cover a variety of financial goals), and because it makes it easy to set up automated transfers from my checking account. The other great advantage—I really like the phone app for monitoring each of my accounts.

Once I walked Mindy and Jim through the details, they were able to see how the 3 Bank Account System could give them much greater clarity about where their money was going and, most importantly, help them reach their goals faster than ever before. Since then, they’ve become the ultimate poster children for the system! They set up their 3 accounts, quickly built up their Emergency Spending Account, and then moved on to growing their Delayed Spending Account using auto-transfers from every paycheck. By putting their new car fund on the fast track, they were able to pay cash for a new minivan in just 12 months—a much-needed purchase after their third child arrived!

When we met last week, Mindy told me that she and Jim had had no idea how much this simple strategy would shift how they plan their finances. “It’s been life changing for us,” she said. Jim was just as enthusiastic. “For the first time, we feel like we know where we’re headed financially. Even our biggest goals— like saving to put three kids through college—feel manageable. It’s a fantastic place to be!”

Looking for more financial insights from Korhorn Financial Group? Subscribe now to The Wise Money Show, our weekly podcast created to help you get wise about your money. New episodes are available each Saturday on our website and social media feeds (Facebook, Twitter, and LinkedIn), and on our YouTube channel where you'll find behind-the-scenes footage of every episode and great bonus content. Check out The Wise Money Show today!